Guide to buying a house in Spain as a foreigner

Buying a house is a very important decision since without a doubt it is one of the largest investments one makes in life. If you also want to buy a house in Spain as a foreigner, it may be that you get a little dizzy because you do not know very well what you are facing: regulations, taxes, expenses, purchase and sale procedures …

This article deals with what are the procedures to buy a house in Spain, what is the procedure prior to the sale, the sale itself and finally the taxes and expenses derived from it. Sometimes this can be a long and complicated process, so my advice is that you always have the help of a good real estate agent. We guide, advise and accompany you at all times. We are prepared to answer your questions, analyze every detail of the process, and, above all, transmit peace of mind and confidence so that the sale is as easy, fast, and comfortable for you, wherever you are.

Are you interested in buying a home in Spain? Well, let’s go for it, for me it is a pleasure that we work together. We started !!

5 steps to buy a home when you are a foreigner in Spain

1º Paso: Tramitación del NIE

When you are a foreigner in Spain, both for professional reasons, for economic interests, or for official actions, you must have your NIE (Número de identificación de extranjeros or Foreigner Identification Number) in force. It is a personal, unique, and exclusive number, of a sequential nature, granted by the Foreigners Office.

This identification number is essential to carry out all kinds of procedures, carry out any economic transaction such as opening a bank account, establishing a business, buying a home or car, filing a tax return, or filling in any administrative application form. inherent in the foreign office. However, it does not qualify you to reside in Spain.

How to apply for the NIE?

- Request it in person at the corresponding Spanish Police General Directorate, provided that you prove the reason for your request.

- Through a representative, granting him the powers that expressly state that he is empowered to submit such a request.

- You can also apply for the NIE from outside of Spain by presenting yourself in person at the Spanish embassy or consular office corresponding to your demarcation of residence.

The processing time is usually a minimum of 3 weeks. At RE / MAX Urbe II we can help you successfully process the NIE when the said request is related to the purchase of a home in Spain. I also anticipate you as an expert in the matter, that it is better to do it from your country since the procedures seem much faster when it is presented at the Spanish embassy than when we manage it from here.

The documentation that will be requested for the processing of the same is:

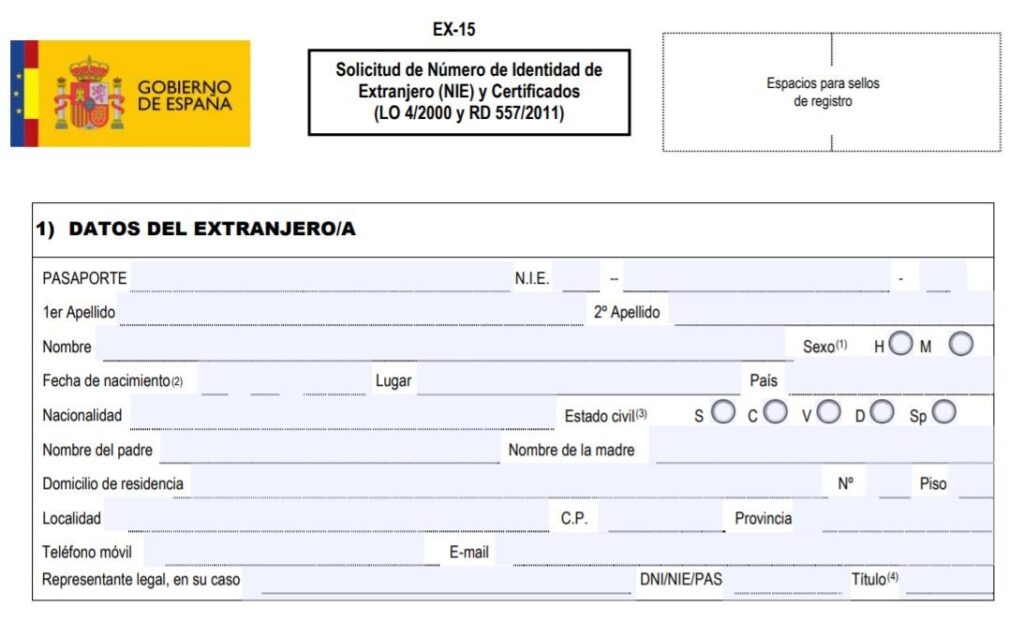

- Form EX15 application form duly completed and unsigned! You must sign it in our presence.

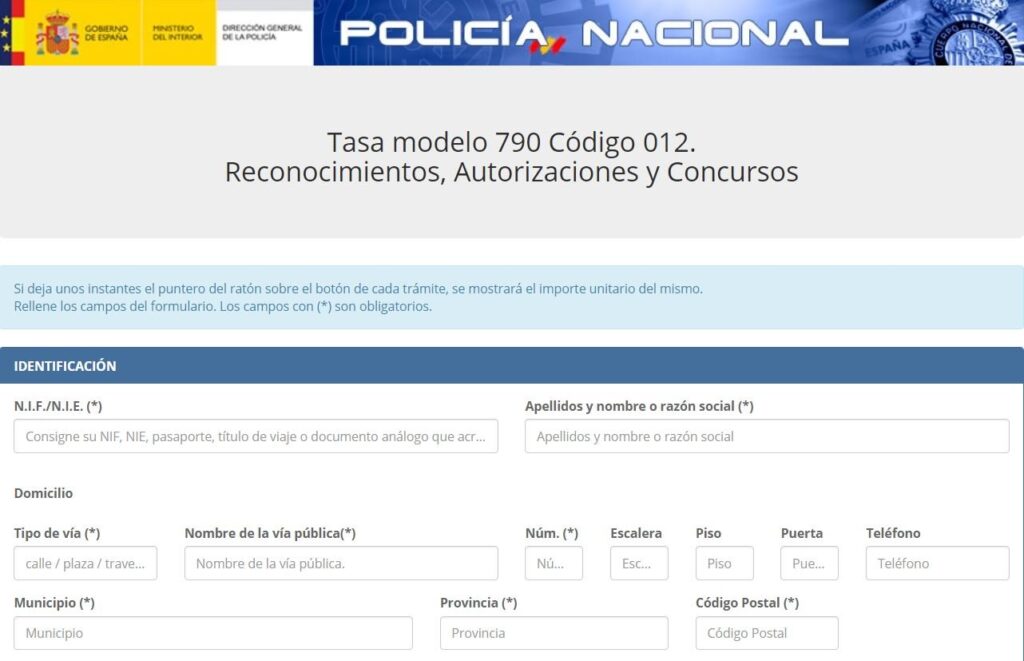

- Form 790-012 certifies the payment of the established fee. To download and print it, it must be correctly filled in, especially the fields defined as mandatory.

- Copy of the supporting documents that prove the reasons why you need the NIE, which I have already commented on above: to buy a house, conduct a business, etc. Ah! And if you are a citizen of the European Union, you are exempt from this section.

- Original passport and a photocopy of the biographical page where the data of its holder are contained and if you are a citizen of the European Union you can provide a copy of your identity card.

- Money Order or cash in dollars to make the payment of the NIE fee: «Assignment of the NIE at the request of the interested party (Model 790 code 012)» in Consular Fees.

2nd Step: Deposit contract

In order to request the NIE when you go to buy a house in Spain as a foreigner, it is necessary that you have signed a deposit contract. This is the document that verifies that you are interested in buying in Spain and it specifies the specific property: exact address of the property, property number, registration in the property registry …

Before signing the deposit contract, an offer/purchase proposal is formalized and a deposit is delivered as a reservation of the property that interests you so that I, as the buyer’s real estate agent, can act as an intermediary with the owners. If it is in the price for which it marks the sale, no problem. The owner signs it and from there we will sign the deposit contract if you do not negotiate your purchase proposal until you reach an agreement with the owners.

The deposit contract is the agreement by which the two parties agree on a reservation right for the sale of movable or immovable property. In it, both parties are identified, the property of the sale and the form and conditions of payment are established, as well as the delivery terms of the advance (10% purchase amount). The final date of the signature at the notary’s office and the distribution of the expenses of the sale between the parties are also specified. This contract also includes the possibility of withdrawal by the parties and how to proceed in that case.

3º Paso: Procedimiento compraventa

Once you have the signed deposit contract and the NIE, all the documentation is prepared to carry out the sale before a notary public. To be able to do this, you must open an account in a Bank of Spain, the one you decide, since on the day of the sale, when you pay the owner, the money must come from a Spanish bank account.

Opening a bank account is necessary during and after buying a home in Spain. Although the NIE is enough, by the Money Laundering Law, the bank will require that the income to that non-resident account be perfectly justified by means of forms that are completed in the country of origin of the funds. That is, you must provide all the necessary documentation to corroborate the legality of the money, whether it comes from an investment fund, your retirement, your savings, a worker’s compensation, etc.

The bank account will serve during the sale to credit all payments made in the property that will be accompanied by a bank certification of the origin of the money. This same bank account is where all utility bills are domiciled: electricity, water, gas, community expenses, and IBI (Annual Real Estate Tax).

Step 4: Taxes

In relation to the taxes to buy a house in Spain as a foreigner: the taxation is the same, the Treasury does not distinguish between resident and non-resident buyers.

If the property is new, the VAT is 10% (in 2020), if it is a second transfer, the Property Transfer Tax (ITP) will be paid, which in the Valencian Community is a general rate of 10%.

Step 5: Purchase and sale expenses

The expenses of the manager, the notary, and the registry, the mortgage, and the sale are quite similar. Both I and all the professionals who make up the Agatha Abellán team inform you of all of them in our meetings, we like that all these details are always clear.

- Notary purchase and sale: It is determined by the value of the sale, and other factors such as the length of the deed or the number of copies also influence, although notary fees (tariffs) are approved by the government and are the same for all.

- Purchase and sale registration: It comprises two types of expenses. On the one hand, we will pay to verify the ownership and charges of the home (if it has an associated mortgage that is being paid, if there are unpaid taxes, etc.) On the other, the registrar is paid to verify the legality of the document and register in the property registry. The cost is associated with the value of the property and the loan.

- Mortgage notary: A percentage of the mortgage liability is paid (the maximum amount that the home responds to in the event of non-payment) that varies according to the entity. According to the new mortgage law of June 2019, this cost will correspond to the bank. The buyer will only have to pay the copy of the deed when buying a house in Spain as a foreigner, or not.

- Mortgage registration: The expenses generated when registering the mortgage in the property registry are also a percentage of the mortgage liability, so it is also the responsibility of the bank to make the payment from June 2019.

- Appraisal: It is necessary that an approved appraisal company certify the value of the property. Therefore, in addition to the mortgage, expenses, and taxes, the buyer has to take charge of the home appraisal. The appraisals are valid for 6 months and must be paid regardless of the approval or not of the mortgage.

- Professional fees for intermediation: in Valencia, the percentage that is applied for this concept is variable but is around 3% of the final purchase value of the property, plus VAT.

- Sales manager: We can hire a manager to do the property registration and tax settlement. If purchased with a mortgage, this manager will be selected by the bank and his fees are not regulated by law. The normal thing is to ask for a forecast of the expense so that later it can be settled by providing proof of the payments made.

At this point, I can only thank you for your trust for having counted on me to carry out this sale and celebrate that you already have your new dream home in Spain.

Congratulations!!

0 comentarios